Beyond One Sale: How to Calculate Your Monthly Break-Even Point

Knowing your profit on a single sale is the first step. The next is understanding how that number scales across your entire business. This is where you connect per-product profitability to your overall monthly goals and determine your break-even point—the moment your store starts making real money.

Using Your “Net Profit / Sale” for Business Planning

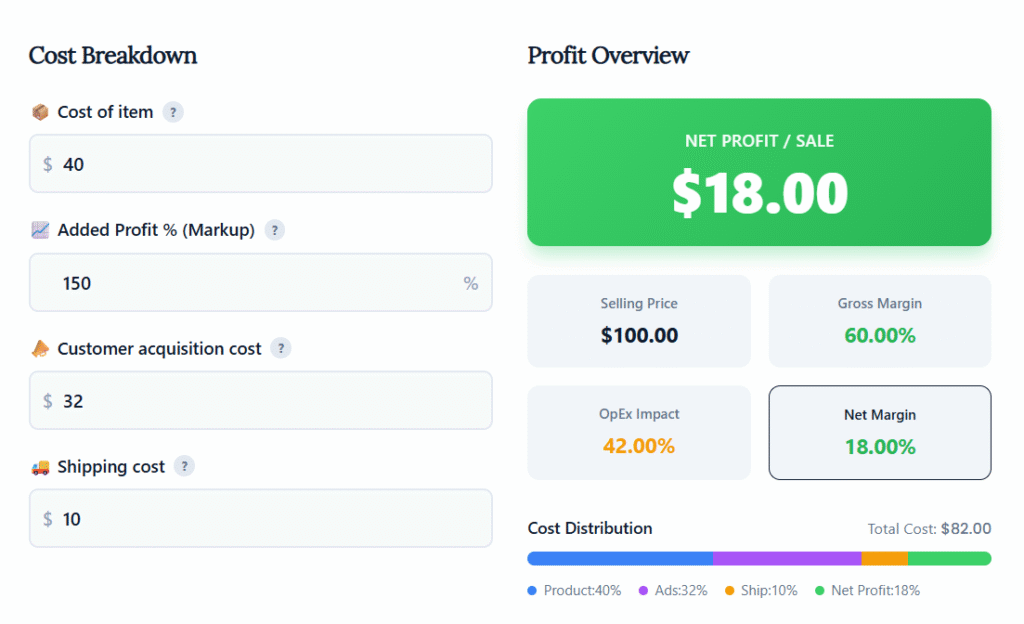

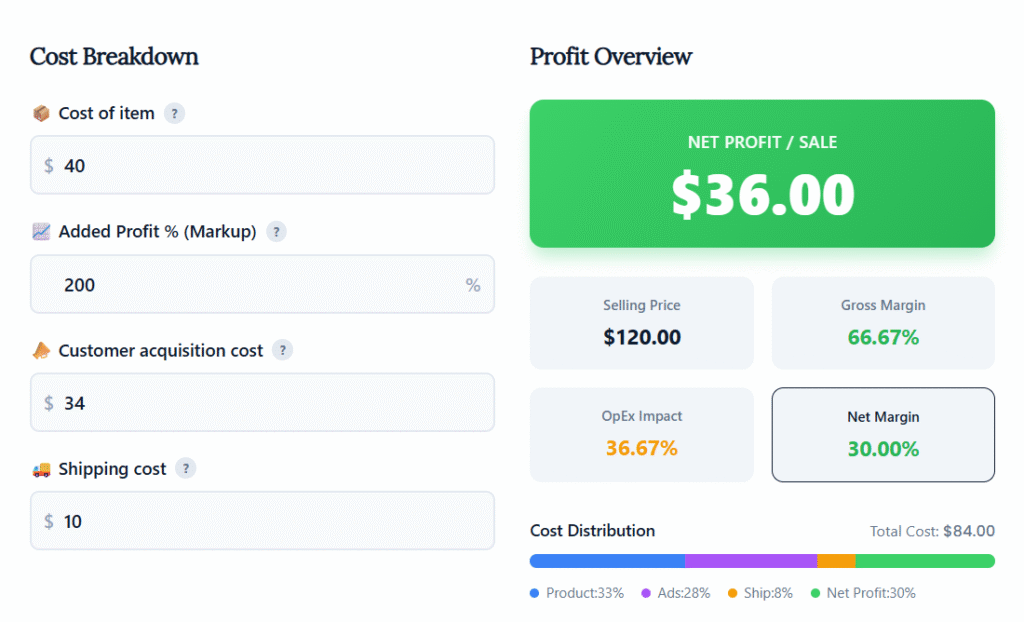

The Net Profit / Sale figure from the calculator is the key to understanding your business’s viability. Think of it as the contribution each sale makes toward paying for your fixed monthly operating costs—the expenses you have to pay whether you make one sale or one hundred. Once those fixed costs are covered, this amount becomes your actual take-home profit.

The Break-Even Formula: How Many Sales Do You Need?

To find out how many sales you need to make each month just to cover your costs, you can use a simple break-even formula. This calculation tells you the minimum number of units you must sell to avoid losing money.

Monthly Break-Even Point (in units) = Total Monthly Fixed Costs / Net Profit per Sale

A Practical Example: From a Single Sale to Monthly Profit

Let’s put this formula into action with a clear, step-by-step example.

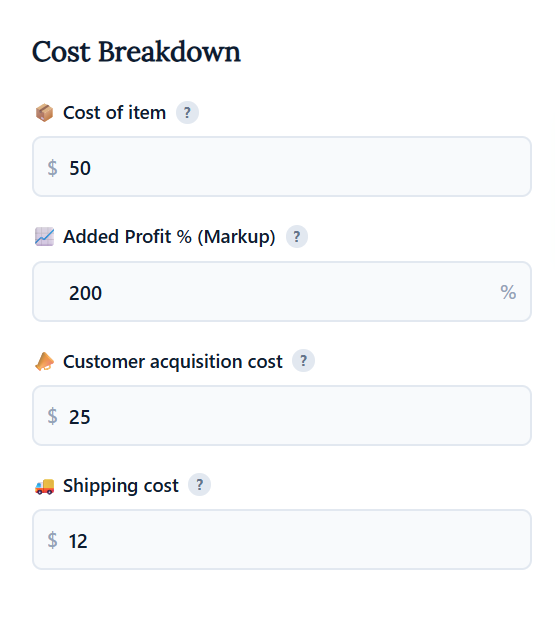

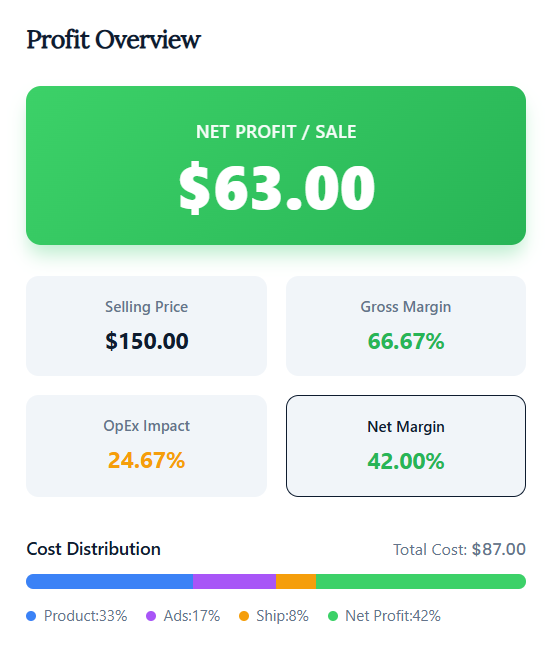

First, imagine our calculator shows your Net Profit / Sale is $63.00.

Next, list your total fixed monthly costs. These are the recurring platform and software fees you pay each month. For a detailed analysis of what to expect, our complete budget breakdown covers the real Shopify website cost.

Don’t forget common expenses beyond just your Shopify plan:

- Shopify Plan: $39/month

- App Subscriptions: $50/month (e.g., for email marketing, reviews, or loyalty apps)

- Other Software: $20/month (e.g., accounting or design tools)

- Total Fixed Costs: $109/month

Now, you can calculate your break-even point:

$109 (Fixed Costs) / $63.00 (Net Profit per Sale) = 1.73

This means you need to sell at least 2 units per month just to cover your fixed costs. Every sale after the second one is pure profit, directly contributing to your business’s growth.